Today, Entelo releases our second report in a series which quantifies gender inequality across industries. Much like our first analysis of the technology industry, this report aims to measure gender inequality by job title, sub-sector, and seniority. This time around, however, we’ve set our sights on the world of financial services.

Financial services companies have talked a great deal about increasing diversity for years. The benefits for those who have walked the walk in terms of embracing gender diversity are clear. A recent study from McKinsey & Co found that organizations within the top quartile for gender diversity are 21 percent more likely to experience above-average profitability than those in the bottom quartile.

But who really knows how big the gaps in gender equality currently are in financial services and what it will take to create a change in the tides across the industry as a whole? Together with our data science team, led by Haroon Rasheed Paul Mohamed, we examined our database of more than half a billion candidate profiles to see exactly what the numbers look like for women in financial services across the U.S.

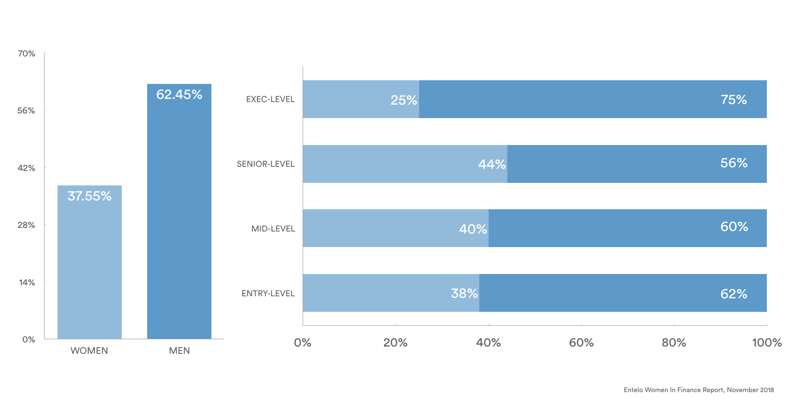

Disparity Across The Industry

When we examine the industry as a whole across all positions, we see a 38 / 62 split between women and men. When we break that down by the level of seniority, we see that women represent a low average of 38 percent in entry level positions. Representation takes a nosedive with executive positions where women represent a mere 25 percent of the industry.

Gender Disparity by Sector

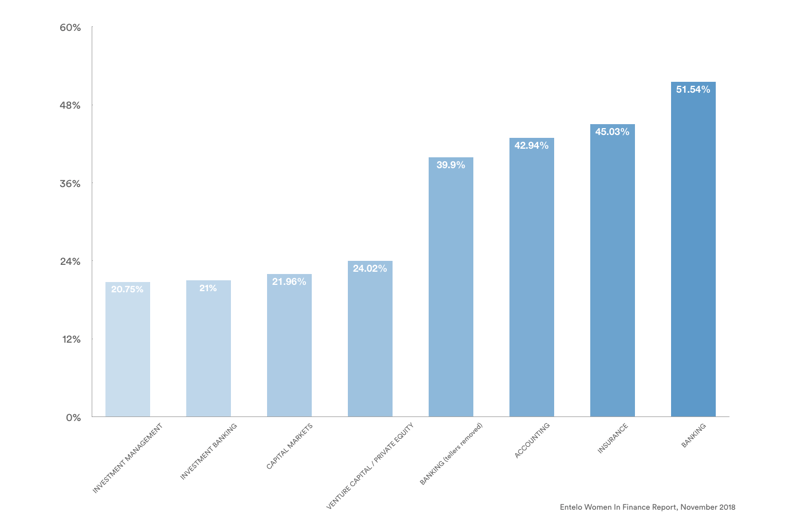

In order to examine this disparity more closely, we broke down the financial services industry into seven subcategories, including: Accounting, Banking, Capital Markets, Insurance, Investment Banking, Investment Management, and Venture Capital / Private Equity.

Our data clearly shows that gender diversity is significantly more problematic in some financial services sectors than others. When ranked from worst to best in terms of female representation, we see Investment Management (20%), Investment Banking (21%), Capital Markets (22%), and Venture Capital / Private Equity (24%) sectors fall way behind their other financial services counterparts.

At first glance, the banking sector seems to be dominated by women, with 51% of employees being female. But when adjusted to remove the bank teller position, the predominantly-female outlier in the dataset, the overall percentage of women drops 11.64 percent to 39.9%.

As Seniority Rises, Equality Falls

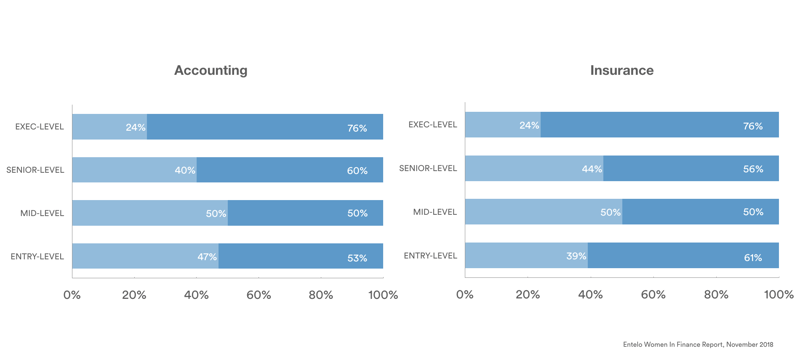

We see a very similar pattern in the accounting and insurance sectors, with very strong female representation in entry-level, mid-level, and senior-level positions. The title ‘Accountant’ itself skews female (63.6% of accountants are female). While ‘Insurance Agents’ are nearly equally male and female (50.1 and 49.9 respectively).

However, as seniority begins to rise, gender equality begins to fall. Presidents, Vice Presidents, CEOs, and Partners are predominantly male. Women make up only 24% of executive-level insurance and accounting positions. For these industries, which are largely equitable in terms of gender in less senior positions, to experience this drastic of a drop in executive positions should be of particular concern. Our data suggests that qualified female talent for these positions likely exists since in mid-level positions the gender representations are similar, and points to a problem at the top.

In a recent survey of financial services professionals, LinkedIn and CNBC found that participants believed a lack of female leadership was a top barrier to women rising in the ranks in finance.

A Disparity In The Talent Pipeline

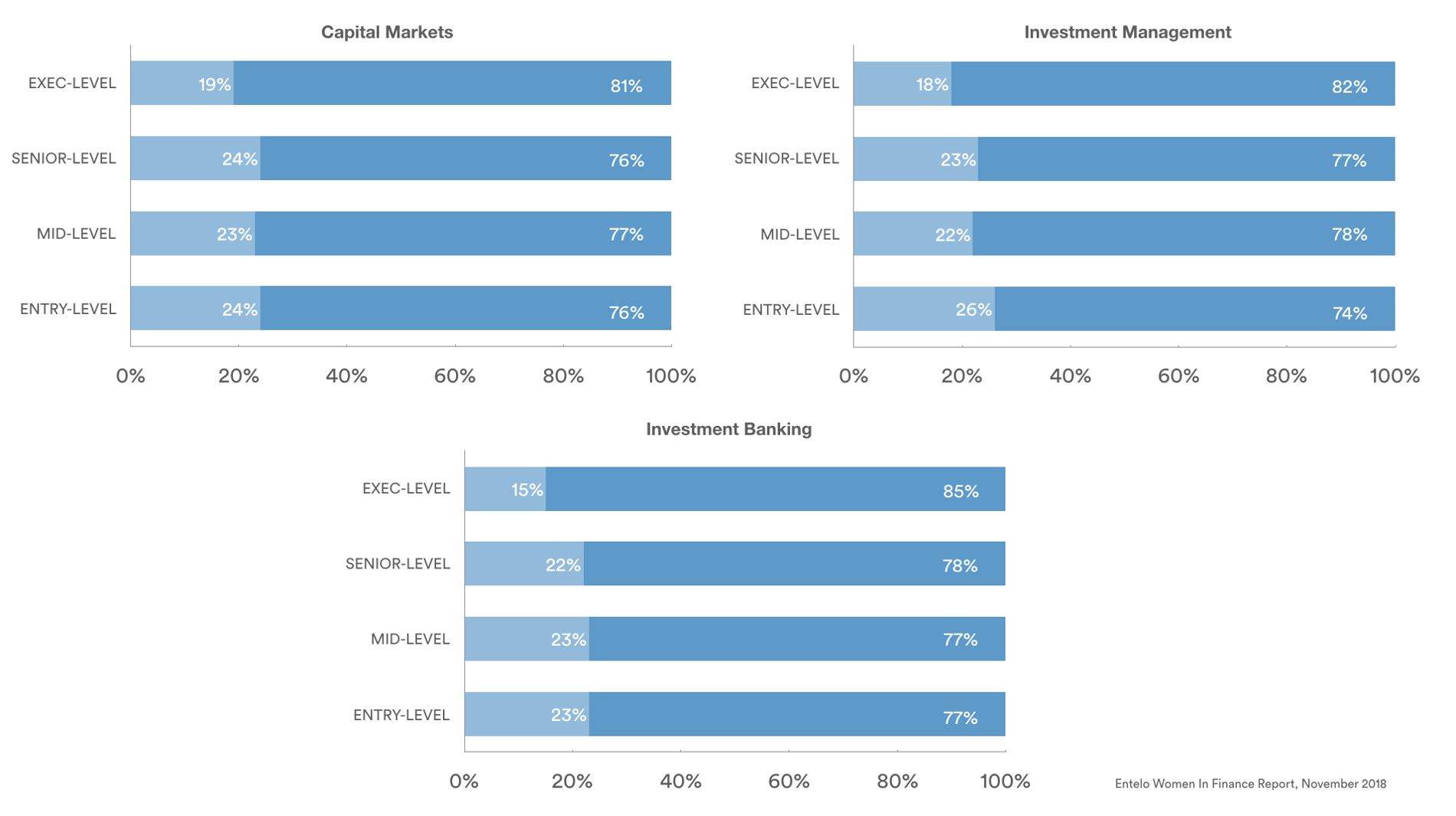

Data from the capital markets, investment banking, and investment management sectors tell a different story. In these sectors, female representation is low in entry level positions, and remains steadily low as seniority rises.

This phenomenon, often described as a “pipeline problem,” refers to the notion that there are too few women entering the finance field to fix the gender gap. Our research would support that theory in this case. Our data for capital markets, investment banking, and investment management suggests that the barrier for women is not only related to general advancement (like equal access to raises and promotions) but also stems from a lack of early education, qualified female talent, or recruitment marketing to women in entry-level positions. In these sub-sectors, the problem exists from the start.

Certain Roles are at Higher Risk

Beyond sub-sector and level of experience, our team also dove in to see how the proportion of women in finance varies by role. Here are 10 of the top roles with the lowest female representation.

Chief Investment officer – 5.1% female

Vice President Investment Banking – 5.5% female

Senior Partner – 8.3% female

Equity Trader – 8.7% female

Trader – 11.8% female

Venture Partner – 12.3% female

Portfolio Manager – 12.6% female

Executive in Residence – 13.7% female

Investment Banking Associate – 14.2% female

Private Equity Analyst Intern – 14.2% female

As hiring managers, recruiters and company leaders think about how to recruit and retain women in finance roles, they should be mindful of which roles are at the highest risk.

Entelo Diversity

With this report, we hope to not only shed more light on the disparities as they exist across financial services roles and sub-sectors, but also to help contribute to the solution. Through Entelo Diversity, our proprietary algorithm allows companies to search for candidates from underrepresented groups based on gender, race/ethnicity, and veteran status. Diversity information is presented with candidate’s matched skill-set and qualifications; and Entelo allows recruiters to review anonymized search results so that companies can objectively hire qualified and diverse candidates.

###

Methodology: This report is based on the Entelo database of over 500 million candidate profiles, analyzed using proprietary machine learning algorithms to examine approximately one billion job changes, to deeply understand the careers of US-based candidates. Candidate profiles include available demographic information such as race and gender in addition to resume information, skill sets and other work-related attributes found across the web. For the purposes of this report, our team looked at finance job titles in financial services companies in our database. Findings are based on data collected from our platform through Nov 20, 2018.